Г

Size: a a a

2019 October 18

Вообще в США много виз. Если рабочая надо быть хорошим спецом, лучше учёным. Если звезда спорта или кино тоже есть виза. Простым смертным или гринка или по политике просить убежище. Или жениться/замуж выйти. Или стать студентом кстати.

А если стать студентом, потом остаться легко?

D

Германия опять таки куча беженцев, Сингапур очень дорогая недвижимость, Корея ее облюбовали наши соотечественники, из Казахстана, хорошие зарплаты. Говорят легко получить визу g1 политическое убежище, и намного проще чем в США.

D

Гоша Бодрый

А если стать студентом, потом остаться легко?

В любой стране если я не ошибаюсь даётся какой то срок на поиски работы

D

Если я не ошибаюсь можете сделать учёбную визу и приехать на языковые курсы и после окончания опять продлевать их. Если курсы вечерние днем можно работать. Но конечно лучше колледж какой нибудь чтобы потом на работу официально устроиться.

D

Я слышал что Финляндия

D

Да эти рейтинги постоянно меняются. Не понятно где правда. Сегодня смотрел интервью экономиста Гуриева он говорит самое лучшее образование частные университеты США.

D

Ну цены разные. Понятно не всем по карману. Около 80 тыс дол в год

Г

Ради интереса погуглил, что за индекс такой. Оказалось:

Since 2010, the Education Index has been measured by combining average adult years of schooling with expected years of schooling for children, each receiving 50% weighting.

Условно, если все дети школьного возраста в стране ходят в школу - заебись, индекс большой. До 2010 года индекс считался по-другому, 2/3 его составлял процент взрослого населения умеющего читать и писать 🤷♂️

Since 2010, the Education Index has been measured by combining average adult years of schooling with expected years of schooling for children, each receiving 50% weighting.

Условно, если все дети школьного возраста в стране ходят в школу - заебись, индекс большой. До 2010 года индекс считался по-другому, 2/3 его составлял процент взрослого населения умеющего читать и писать 🤷♂️

Г

Выбирать надо не по индексу, а по тому, где ЛИЧНО тебе будет лучше и вкуснее.

Г

И в настоящее время, я считаю, в Австралии мало кому будет вкуснее, по причинам которым я описал выше.

Г

Самая большая тягота Австралии в настоящий момент в том, что профессионал из СНГ - айтишник ли, инженер ли, неважно - просто сюда не сможет попасть напрямую. Либо уедет в буш, к папуасам, на 3-5 лет, и будет там всей семьей проедать свою бабкну квартиру в Воронеже, работая на мясокомбинате, теряя квалификацию и остановившись в развитии.

Г

Тебе парят мозг. Агент аффилирован с универами/курсами и имеет с них процент. Поэтому он заинтересован «продать» тебя на нужный агенту курс.

А еще спроси, имеет ли он право брать денег еще и с тебя- и смотри, как он будет юлить 😁 Потому что не имеет. Но берет, это же Россия / Средняя Азия, лол.

А еще спроси, имеет ли он право брать денег еще и с тебя- и смотри, как он будет юлить 😁 Потому что не имеет. Но берет, это же Россия / Средняя Азия, лол.

Г

Ок. Какой курс собираешься делать?

Г

Слушай, мне прямо стало интересно. Как это так в Австралии можно найти образование дешевле, чем вне ее? Я не понимаю схему.

Возможно, агент имеет в виду получив вид на жительство (он же PR) образование будет дешевле? Так-то оно так, но только как этот PR получить?

Возможно, агент имеет в виду получив вид на жительство (он же PR) образование будет дешевле? Так-то оно так, но только как этот PR получить?

Г

Давай сравним объективно.

Г

Германия

Individual income tax in Germany: 2019 rates

The first €9,169 (or €18,338 for married couples submitting a combined return) earned each year is tax free. Any amount after that is subject to income tax.

Income tax in Germany is progressive: first, income tax rates start at 14%, then they rise incrementally to 42%; last, very high income levels are taxed at 45%. The top tax rate of 42% applies to taxable income above €55,961. Finally, for taxable income above €265,327, a 45% tax is applicable.

Individual income tax in Germany: 2019 rates

The first €9,169 (or €18,338 for married couples submitting a combined return) earned each year is tax free. Any amount after that is subject to income tax.

Income tax in Germany is progressive: first, income tax rates start at 14%, then they rise incrementally to 42%; last, very high income levels are taxed at 45%. The top tax rate of 42% applies to taxable income above €55,961. Finally, for taxable income above €265,327, a 45% tax is applicable.

Г

Г

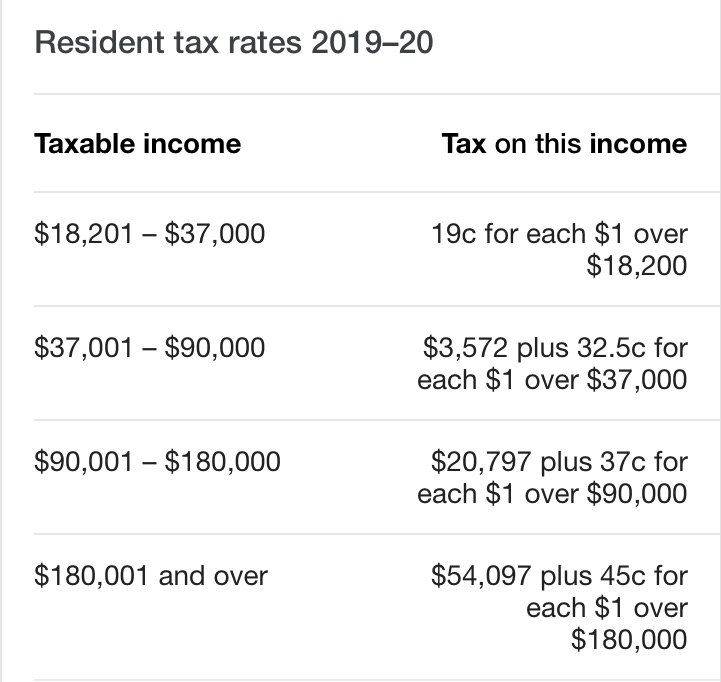

Австралия

Г

А я посчитаю, я дотошный

Пускай есть инженер, и он получает 50000 euro. Что равно 81413 aud

В Германии:

50000 euro

12971 налог

налог 25.9%

В Австралии:

81413 aud

18006 налог

налог 22%

Пускай есть инженер, и он получает 50000 euro. Что равно 81413 aud

В Германии:

50000 euro

12971 налог

налог 25.9%

В Австралии:

81413 aud

18006 налог

налог 22%

Г

Ты собираешься ехать учиться в Австралию?