TO

Size: a a a

2020 June 02

У банкоматі чи у відденні має бути світло, тоді гроші будуть працювати

฿

Це відкрита інформація, банківські баланси публічні

Ну і де її взяти?

Скільки електроенергії споживає світова фін система?

Скільки електроенергії споживає світова фін система?

TO

Ну і де її взяти?

Скільки електроенергії споживає світова фін система?

Скільки електроенергії споживає світова фін система?

Бачив обрахунок, що десь 8% ввп. Це ще ж прибутки і зарплати

฿

2020 June 03

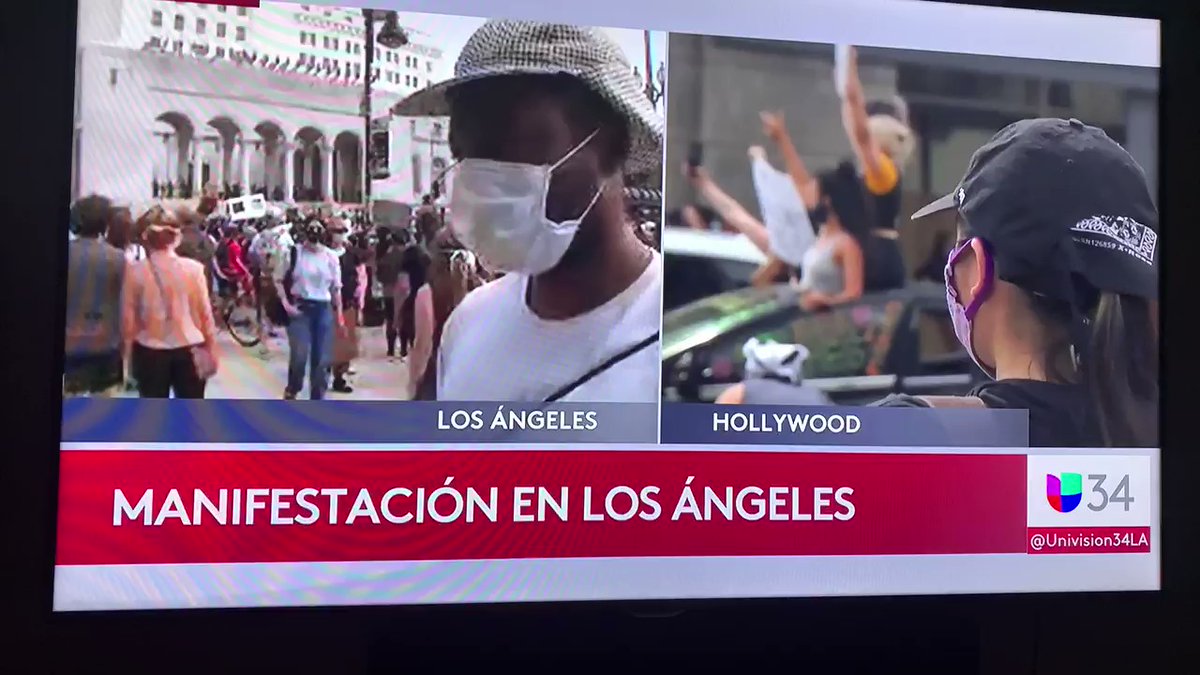

VS

Ого...

RS

Це порошенко, його ж досі не посадили

AR

RS

VS

TO

And Rey

Зачет)

C

Это звучит нереально ))

C

Черногория объявила о прекращении эпидемии коронавируса

В течение 28 дней в стране не было зафиксировано новых случаев заражения коронавирусом.

▪️ПУЛЬС УКРАИНЫ

В течение 28 дней в стране не было зафиксировано новых случаев заражения коронавирусом.

▪️ПУЛЬС УКРАИНЫ

RS

Вообще понятие пандемия относится к большому количеству стран, так что одна страна никак не могла это объявить. Другое дело что эта ситуация вообще далеко не пандемия 😂

C

Goldman Sachs’ Consumer and Investment Strategy Group gave a presentation last week that, in our opinion, severely underestimated Bitcoin’s value for global payments and savings.

At Kraken, we feel it’s important to inform our clients why we think differently about this innovative asset that’s core to our brand.

Quite simply, Bitcoin has overcome many barriers to adoption, growing to a $170 billion market capitalization in 10 years with no marketing team, no investment bank backing and no support from governments.

If you’re still new to the technology, it’s important to first understand Bitcoin shares many of the properties that give traditional commodities and government monies value – scarcity, durability, portability, divisibility, fungibility and acceptability.

Our Bitcoin primer “Vires In Numeris” is a balanced report that addresses many of Goldman’s arguments and covers topics essential to understanding Bitcoin, including its:

Adoption and Use: Not a currency? The data simply tells a different story. Explore how Bitcoin has grown since 2009 by transaction volume, wallet downloads and mining hashrate, and why these metrics matter.

Origins and History: Too volatile? Learn how Bitcoin has grown out of decades of computer science research to achieve a market never before thought possible. We include a timeline of Bitcoin’s major events and inspirations.

Protocol and Technology: Not suitable for investment? Review the major components of Bitcoin’s protocol and learn how they have been combined to secure value stored on the blockchain for nearly a decade.

Download the Full Report

Please feel free to forward this report to friends, family and coworkers who are interested in learning more. You can read the full Goldman Sachs report and its findings here.

The Kraken Team

At Kraken, we feel it’s important to inform our clients why we think differently about this innovative asset that’s core to our brand.

Quite simply, Bitcoin has overcome many barriers to adoption, growing to a $170 billion market capitalization in 10 years with no marketing team, no investment bank backing and no support from governments.

If you’re still new to the technology, it’s important to first understand Bitcoin shares many of the properties that give traditional commodities and government monies value – scarcity, durability, portability, divisibility, fungibility and acceptability.

Our Bitcoin primer “Vires In Numeris” is a balanced report that addresses many of Goldman’s arguments and covers topics essential to understanding Bitcoin, including its:

Adoption and Use: Not a currency? The data simply tells a different story. Explore how Bitcoin has grown since 2009 by transaction volume, wallet downloads and mining hashrate, and why these metrics matter.

Origins and History: Too volatile? Learn how Bitcoin has grown out of decades of computer science research to achieve a market never before thought possible. We include a timeline of Bitcoin’s major events and inspirations.

Protocol and Technology: Not suitable for investment? Review the major components of Bitcoin’s protocol and learn how they have been combined to secure value stored on the blockchain for nearly a decade.

Download the Full Report

Please feel free to forward this report to friends, family and coworkers who are interested in learning more. You can read the full Goldman Sachs report and its findings here.

The Kraken Team

฿

Нацбанк увів в обіг монети номіналом 10 гривень. https://bbc.in/2XuWzXg

C

Отрывок из пламенного выступления "минера" моста Метро в Киеве на суде.

Сейчас решается вопрос что с ним делать.

Подписаться | Прислать новость | Наш Чат

Сейчас решается вопрос что с ним делать.

Подписаться | Прислать новость | Наш Чат

฿

Отрывок из пламенного выступления "минера" моста Метро в Киеве на суде.

Сейчас решается вопрос что с ним делать.

Подписаться | Прислать новость | Наш Чат

Сейчас решается вопрос что с ним делать.

Подписаться | Прислать новость | Наш Чат

Не хоче тут жить чи шо?

От що буває коли світогляд тісно пов'язаний з державою - не виправдані сподівання, надії на державу, призводять до викривлення психіки і відриву даха. 😊

От що буває коли світогляд тісно пов'язаний з державою - не виправдані сподівання, надії на державу, призводять до викривлення психіки і відриву даха. 😊

C

Не хоче тут жить чи шо?

От що буває коли світогляд тісно пов'язаний з державою - не виправдані сподівання, надії на державу, призводять до викривлення психіки і відриву даха. 😊

От що буває коли світогляд тісно пов'язаний з державою - не виправдані сподівання, надії на державу, призводять до викривлення психіки і відриву даха. 😊

Так, не можна тут жити, бо держава не дає.